Introduction: Since March, opinions on the domestic PTA market have been relatively divergent. Prices have been mixed, ranging from a sharp rise to a rapid correction. The spot price of PTA has now fallen to 4,425 yuan/ton, which is higher than last week’s highest value. A month-on-month decrease of 6.65%. The rally is continuing to retreat, so is the short-term market development direction bullish or bearish? Let’s take a look at PTA’s supply and demand fundamentals.

The recent rise to decline of PTA is essentially nothing more than a retrenchment of the previous gains. According to the previous view, with the support of Brent crude oil continuing to rise, PTA’s own supply will be short-term. With the benefits of the narrowing and the increase in downstream polyester load, coupled with the fact that PTA’s own processing profits are at a low level, there may be a possibility of a rebound in PTA in the short term. But in fact, the market expects U.S. crude oil inventories to increase for the fourth consecutive week, and international oil prices fell for the third consecutive day. Problems with European vaccines and the mutation of the US strain have made the economy and demand full of uncertainty, curbing gains in the crude oil market. Therefore, we temporarily attribute it to the weakening of upstream international oil prices, which led to the downward adjustment of PTA and the emotional transmission of international macroeconomics.

PTA supply and demand fundamental trend

Source: Longzhong Information

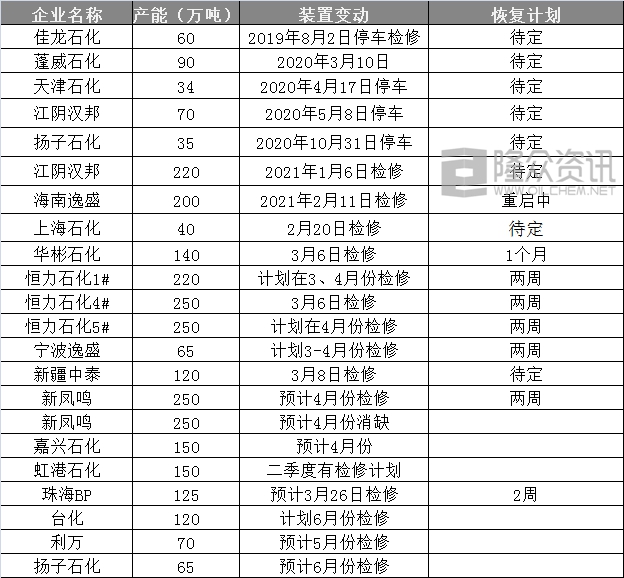

Recent PTA device updates

Source : Longzhong Information

The supply and demand fundamentals of PTA from March to April are relatively impressive. First, from the supply side, short-term PTA fundamentals are still relatively good. With the progress of equipment maintenance, PTA operation has dropped to 77.59% under the maintenance of Reignwood Petrochemical, Hengli Petrochemical, Hainan Yisheng, Xinjiang Zhongtai and other enterprises. From the end of March to April, as the number of PTA device maintenance companies continues to increase, the operating rate of domestic PTA devices will continue to decline. Secondly, from the perspective of demand, the current operating rate of polyester production has steadily increased, with the current operating rate rising to 93.14%. The current comprehensive operating rate of chemical fiber weaving in Jiangsu and Zhejiang is 70.27, an increase of 5.70 percentage points from the previous month. Therefore, in the short term, when supply and demand are favorable, and when oil prices are stable, PTA currently believes that there is limited room for continued decline.

PTA market outlook risk judgment:

1. The market is worried that U.S. commercial crude oil inventories will increase for four consecutive weeks. , and the vaccination process in European and American countries has been hindered, the demand outlook has been affected, and international oil prices have continued to fall, dragging down chemical product costs and mentality.

2. The PTA social inventory of nearly 5 million tons in the medium and long term will still suppress the market upside space.

3. Downstream polyester production and sales continue to be poor, and inventories continue to accumulate.

4. Downstream terminal demand market transmission is not smooth.

Based on the current domestic PTA upstream and downstream market conditions, the short-term supply side still shows a downward trend, and there is still support on the demand side. Therefore, supply and demand are good for the PTA market in the short term. Therefore, even if the current spot market price of PTA futures has corrected, the overall decline is expected to be limited. There is currently no stimulating news to boost the market. </p