Foreign news on September 1, the International Cotton Advisory Committee (ICAC) released a report on Thursday stating that large-scale flooding in Pakistan has worried the entire global cotton industry.

The impact on the cotton crop will not be fully felt until the floods subside, but reports indicate that cotton production is expected to be significantly reduced in 2022/23. ICAC currently lowers Pakistan’s cotton production from 1.5 million tons to 1 million tons.

In the United States, the cotton crop in Texas has been devastatingly affected, with production now expected to be down by more than 1 million tons compared to the previous season. This brings current US production to just over 2.7 million tonnes. While West Texas has received a lot of rain over the past few weeks, it has come too late for dryland cotton — which can lead to quality issues if bolls open in irrigated fields.

The ICAC Secretariat’s current seasonal average price A index forecast for 2022/23 is between 99 cents and 157 cents, with a median value of 126.95 cents per pound.

On the other hand,according to The Paper and other reports, Pakistan’s Minister of Climate Change Shirley Lehman announced on August 30 It said that Pakistan has been suffering from floods since June this year. Currently, about one-third of the country has been completely submerged by floods. More than 30 million people have been affected by the floods, which have resulted in a total of more than 1,100 deaths.

Affected by the floods, nearly half of the cotton grown across the country was washed away by floods, and fruits, vegetables and rice fields were also severely damaged.

What is the impact on yield?

According to the China Merchants Futures Research Report, among the world’s major cotton producing countries, India and China rank the top two, followed by the United States and Brazil, followed by Pakistan and Uzbekistan, which are all traditional cotton producing countries.

In terms of consumer countries, except for Brazil, they are basically Asian countries. India, China, Pakistan, Brazil, and Uzbekistan are both major producers and consumers.

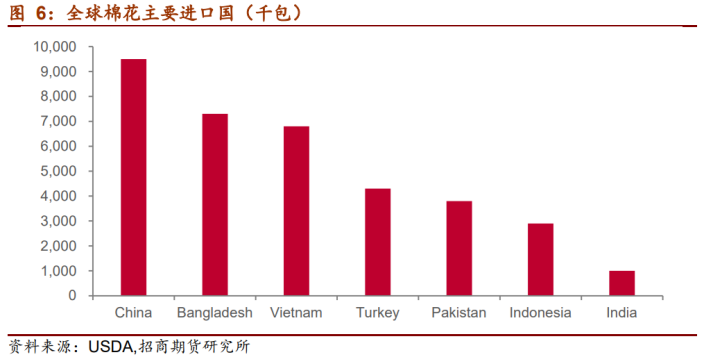

In terms of exporting countries, the United States and Brazil account for half of the country, and India also plays an important role; in terms of importing countries, China, Bangladesh, Vietnam, Turkey, Pakistan, Indonesia, and India are all important centers in the global textile industry. The common feature is a large population. , labor costs are cheap.

According to analysis by Pakistan’s Ministry of National Food Security and Research, the national cotton output is expected to drop by more than 30% this year due to the impact of the floods.

In other countries and regions, the ending inventory of U.S. cotton in August decreased by 131,000 tons from the previous month, and the inventory-to-consumption ratio was 12.6%, a year-on-year decrease of 8 percentage points, which is the lowest level since 1924/25. In addition, extreme high temperatures in Uzbekistan led to a decrease in yields, and cotton production was reduced by 22,000 tons. Global cotton trade volume decreased by 392,000 tons month-on-monthDomestic cotton supply and demand situation

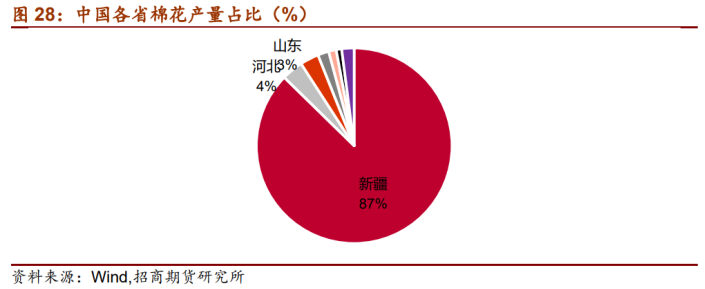

Data show that under the guidance of policies such as direct subsidies, domestic cotton planting has gradually concentrated in Xinjiang, the advantageous production area. In recent years, a relatively stable pattern has been formed. Xinjiang’s output is stable, and the mainland accounts for a small proportion.

In terms of imports, the market consensus is that domestic cotton production is about 5-6 million tons, and consumption is 7-8 million tons. Cotton imports normally remain at a level of about 2 million tons. Imported cotton is still very important to my country’s downstream textile industry. occupy a relatively important position.

According to the China Merchants Futures Research Report, since cotton rose sharply to the level of 21,000-22,000 in October 2021, upstream expectations on the supply side have strengthened, and a large amount of spot stock has been hoarded; on the other hand, downstream profits have turned sharply into losses at this time, and demand has also increased. Overseas production is gradually normalizing and domestic production is affected by the epidemic and is struggling under many adverse impacts. This has intensified the contradiction between upstream and downstream, causing a serious stalemate and differentiation between supply and demand.

As time went on, the area of new cotton planting increased slightly, and the weather during the planting period was normal. After several months of upstream holdings, the basis spread began to be lowered after loan pressure and confidence in price expectations loosened. For goods, prices finally began to gradually decline in May and June, benefiting downstream companies.

The industry may continue to maintain weak supply and demand

The industry may continue to maintain weak supply and demand

Industry media Futures Daily said that the domestic cotton market maintains a pattern of weak supply and demand, and it is likely to continue in the next year. The loose supply situation continues, and the benefits brought by purchasing and stockpiling are relatively limited.

In terms of supply, cotton planting expansion is expected to take place in Xinjiang. The survey results showed that 202In the past two years, the actual cotton sowing area in Xinjiang was 36.904 million acres, an increase of 1.344 million acres year-on-year, an increase of 3.8%. The weather for cotton planting in Xinjiang this year is suitable. The temperature is high and the weather is good. The cotton is growing well and the growth and development period is advanced. The cotton yield per unit area is expected to be higher than in previous years.

In terms of demand, its analysis said, “Weak consumption is still the main contradiction and has not been effectively resolved. All links in the industrial chain, from cotton to gray fabrics and clothing, are facing the problem of difficulty in destocking. From changes in production starts, profits and finished product inventories Judging from the trend, it is still in the passive inventory replenishment stage. Although the upstream cotton raw materials have repeatedly reduced prices and the spot profits of spinning have significantly improved, due to the limited purchase volume, the main products are still high-priced cotton or high-cost cotton yarn that needs to be digested. In addition, Affected by the weakness of the terminal consumer market, the textile industry may need to proactively reduce prices to remove inventory if it wants to get rid of the passive situation of high inventory and weak orders. This will also become one of the signals that prices have bottomed out.”

Looking forward to the market outlook, China Merchants Futures pointed out that the current cotton price can effectively stimulate supply. Even if there are various problems, supply is still expected to grow, while demand is facing greater pressure in the current environment. , the overall expectation is pessimistic. In the second half of 2022, with the growth of new cotton supply and considering the current weak demand pattern, prices should drop to a range to find a new balance. </span